The Biggest Mistake Startups Make when Picking their ICP

The most important thing in your marketing strategy and the biggest mistake startups make

The biggest mistake I see startups make often is hiring in demand gen prior to hiring product marketing. Product marketing defines your ICP, positioning and messaging.

If you don’t have a properly defined ideal customer profile (ICP), then campaign after campaign you’re throwing away a lot of money.

The ICP drives your messaging and your positioning, not the other way around. Without proper ICP definition and proper messaging, demand gen and sales cannot inbound or outbound successfully.

Focus

The other big mistake I see most B2B SaaS startups make is they have a great idea for a product but then people start using it in unexpected ways so they start expanding their ICP to include everyone in their target market.

You cannot be a product for everyone. Period.

The most successful companies have focused on one ICP and gone after it hard. Some examples:

Mutiny - initial hard core focus on ABM managers in B2B SaaS

Twilio - initial and continued focus on developers

Canva - initially targeted freelance/SMB social media managers

Gong - initially targeted sales teams in N. America, who used video conferencing to sell

When you have focus, you get a group of people excited about your product and your brand. Ultimately, it makes it easy for you to deliver on your brand promise.

How do you pick your ICP?

There are many ways to skin a cat and you may have more than one ICP you could go after, but the more narrowly focused you are, the better the chance of dominance.

Here are some things to look at:

Pain point you’re solving (e.g. moving to the cloud, ABM personalization, compliance)

Geo (e.g. state, country, region)

Language (if you’re not localized then stick to your native language). Also see this post of when to expand.

Business type (e.g. b2b SaaS, b2c, fintech, CPG)

Company size (e.g. revenue, # of employees)

Persona title(s) (manager, director, VP, C-suite, individual contributor)

Persona role (e.g. marketing, sales, finance, developer, founder)

Persona type (e.g. content marketer, recruiter, frontend developer)

Tool stack (Github, Salesforce, Wordpress, etc.) - a good way to figure this out is look at existing customers or your competitors customers to see commonalities in their tech stacks. I’ve used BuiltWith in the past.

Conquering your ICP

Once you have your ICP you can develop your TAM (total addressable market) and your SAM (sellable addressable market). There was an interview with Gong where they said in the early days when they narrowed down their ICP it was only 5000 total accounts that fit their ICP profile. They of course expanded, but the point is, starting out small is okay.

The biggest mistake I see startups make is not conquering their ICP in their SAM and then expanding too soon.

As I talk about in the above post, this puts a strain on marketing, because often there is not enough content for the new expanded ICP or it puts a strain on sales by adding new territories with no boots on the ground in those geos.

Ways to tackle your TAM and SAM

Your TAM (total addressable market) is a dollar amount. It’s your average contract value (ACV) multiplied by the total amount of customers in your ICP.

Example: You sell custom dog food for $25 a bag in the U.S. The average number of dogs in the U.S. is around 89.7M. Therefore your TAM is ($25) x (89,700,000) = $2,242,500,000 ($2.4B)

Creating the TAM is a team effort, often falling on the CMO leading the charge. In B2B SaaS, this responsibility falls to a group of individuals:

CMO - typically leads the marketing strategy and is responsible for understanding market dynamics, customer segments, and overall market size. They often conduct or oversee market research to accurately define the TAM.

CEO - sets the strategic direction and may be involved in high-level discussions about market potential or growth opportunities

Product - Members of the product team may also contribute by providing insights into customer needs, the product roadmap, and how the product fits into the broader market landscape.

Board of Directors - the Board isn’t directly involved, but they can influence the TAM based on setting strategic or growth goals (or strongly opinionated board members.)

Market Analysts - some companies may hire external experts to conduct detailed market analyses, but this is not the norm

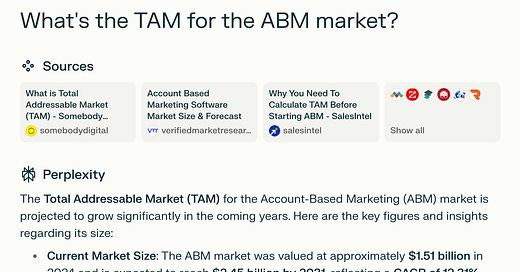

Tackling the TAM usually involves some internet research (Perplexity, Claude, Google) to determine the overall market size of your ICP from industry reports or studies. The key is to be specific as possible with your ICP or use cases for a realistic view.

For example, if I ask Perplexity what the TAM is for the ABM market, it comes back with:

Your SAM (sellable addressable market) is what you can realistically target based on your marketing, sales, and product capabilities. This is different for each GTM team based on resources (people and program dollars) and product features.

Example: You sell custom dog food for $25 a bag in the U.S. The TAM is $2,242,500,000. Assuming you can serve 10% of the market, your SAM would be looking at a SAM of 2,242,500,000 × 0.10 = 224,250,000 ($224.25M)

When calculating the percent you can serve, always go with a modest number, such as 10-20%.

Once you nail your ICP, TAM, and SAM, you’re ready to put together your Marketing strategy, Brand, and Demand Gen programs.

If you found this useful check out how to use AI to identify ICP and positioning post.